Simple. Smart. AI-Powered Finance.

De-risk investment, unlock capital, and accelerate growth.

Our Solutions

Who We Enable

Investors & philanthropists

PaySoko equips public, private and philanthropic financiers with powerful capital management, investment syndication, Uliza AI (via HI-VE) and improved clarity, reducing analytic and administrative costs, while enhancing the performance and management of their investments

Lenders & Buyers

Using our proprietary HI-VE AI models we provide solutions that hyper-optimize the lending process for banks, credit unions, CDFIs, fintech lenders and next-generation reducing costs and risks, while accelerating revenue and ROI

Business Customers

PaySoko provides a powerful business operations suite with embedded financing, enabling businesses, to drastically reduce their cost of operations, seamlessly integrate business intelligence into their day-to-day and significantly increase retention and acquisition

Solution by Industries

PaySoko’s Business Suite provides verticalized solutions that seamlessly integrate with our financial platform, enabling businesses across multiple segments to operationalize “the way they work” with the power of our Uliza AI, optimizing their financial performance with never before seen capital access solutions to further increase their competitive edge and market agility.

- All

- Construction Development

- Retail

- Hospitality

- NGOs

- Infrastructure

Our construction solution facilitates the development underwriting process and construction lifecycle, Our AI provides powerful capabilities for pressure testing financial strategies, while providing valuable site tools to optimize all phases of residential and commercial development

Our retail solutions provide point-of-sale (POS), accounting, HR, inventory and floor management tools to inform sales strategies, amplify customer engagement and improve comps, all while offering opportunities to dynamically extend capital access.

Our lineage is in the hospitality industry, we provide a wealth of interactive solutions that help to maximize customer engagement, optimize loyalty programs, automates next best offers and further enables continuity with brands on-and-off property

Transparent fund disbursement and impact-linked finance.

Development organizations, donors, and social funds use PaySoko to:

- Deploy capital to field programs or partners with milestone validation

- Ensure fund flow accountability and build trust with funders

- Track field activity, expense burn, and KPI delivery in real time

From impact grants to blended finance, PaySoko brings structure, integrity, and insight to mission-driven capital.

Disbursement integrity for large-scale national projects.

Governments, PPPs, and project sponsors use PaySoko to orchestrate multi-stakeholder capital flows with clarity:

- Smart contracts for milestone-based funding

- Integrated reporting for ministries, lenders, and regulators

- Faster delivery with lower leakage

Business Suite

Finance-related Benefits

Access to Embedded Financing: Businesses can seamlessly apply for and access financing directly from within the ERP — no need for separate loan applications or leaving the platform.

Improved Cash Flow Management: Integrated finance tools help businesses track receivables, payables, and funding options in real time to stay liquid and avoid cash crunches.

Inventory Management

Smarter Inventory Control: Track stock levels, manage reorders, and reduce waste with real-time inventory insights — all integrated into your operations.

CRM (Customer Relationship Management)

Stronger Customer Relationships: Consolidate customer data, manage leads, track interactions, and personalize service to build loyalty and increase sales.

Accounting

Simplified Financial Records: Automate bookkeeping, generate invoices, and ensure compliance — reducing errors and saving time on monthly closings.

HR & Payroll

Streamlined HR & Payroll: Manage employee records, track attendance, and automate payroll, ensuring compliance and improving staff satisfaction.

Industry-Specific Modules

Tailored to Your Industry: Includes modules designed for specific sectors (e.g., agriculture, retail, manufacturing), so businesses can operate more effectively with relevant workflows.

Financial Institutions

Business Customers

Access to Funding

Solution Highlights

Smart Tools. Seamless Operations.

- All

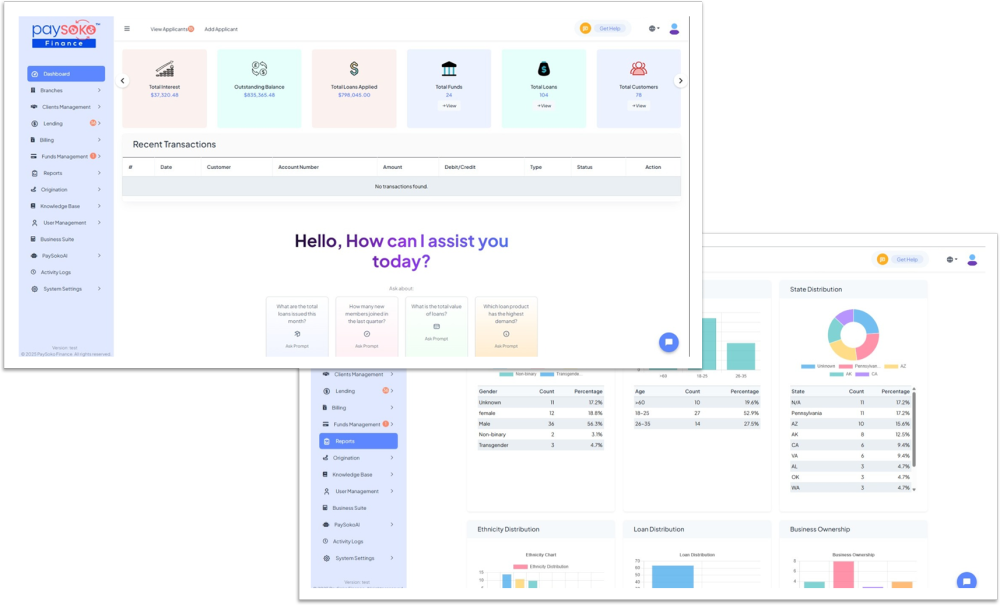

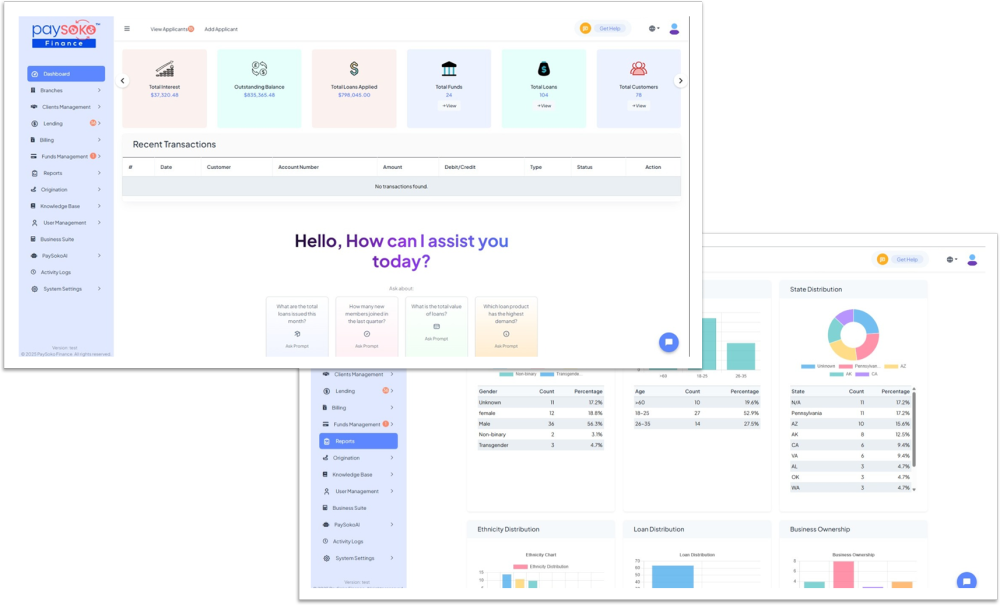

- Uliza AI

- Automated Loan Servicing

- Financial Analysis & Spreads

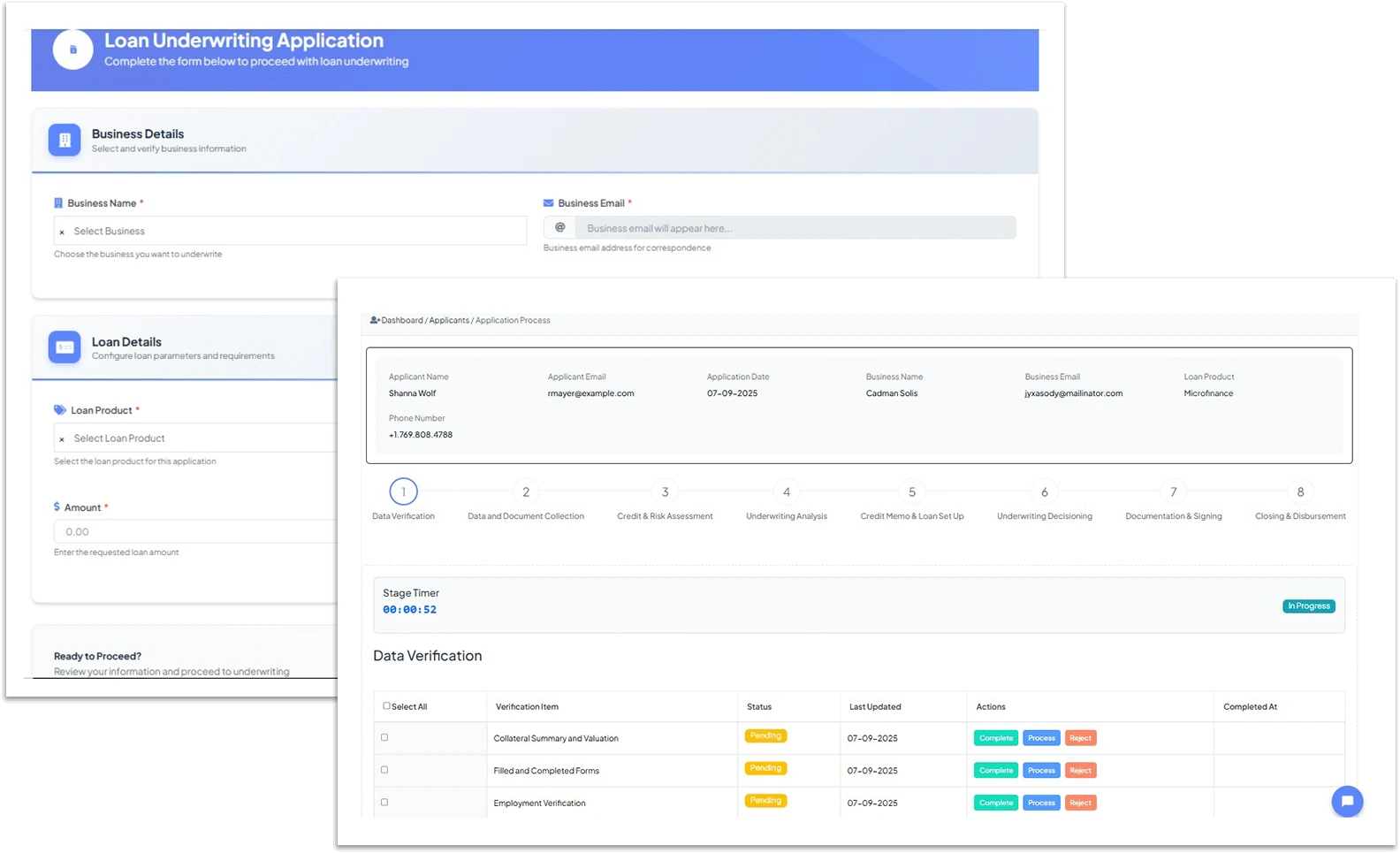

- Origination

- Multi-Industry ERP

Uliza is a powerful AI "wingman" that utilizes our HI-VE models to automate, inform, analyze, consume and synthesize your data across the PaySoko capital ecosystem of solutions, providing an easy to use prompt interface with our unique "value highlights" cards, proactively informing your business needs and future strategic priorities

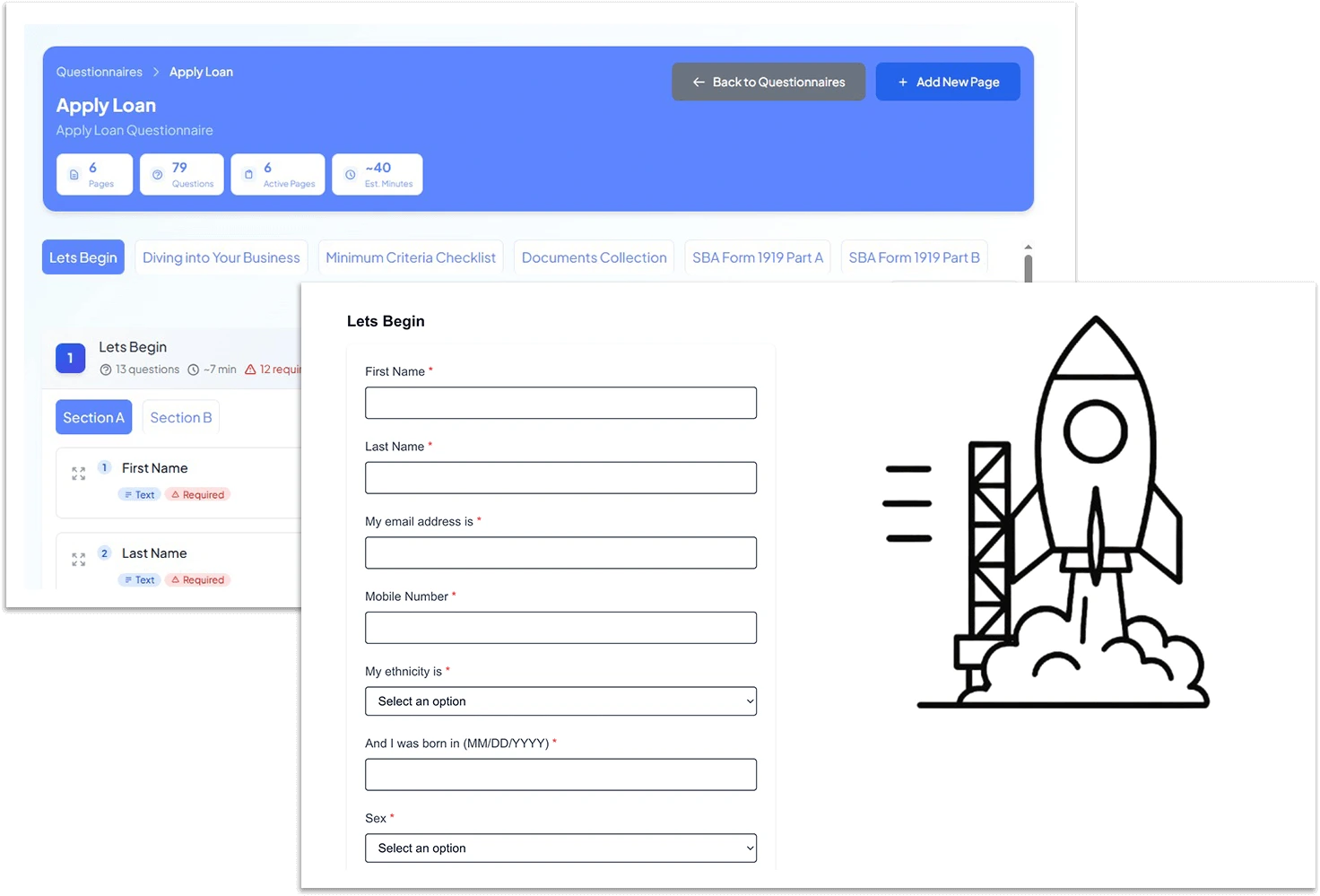

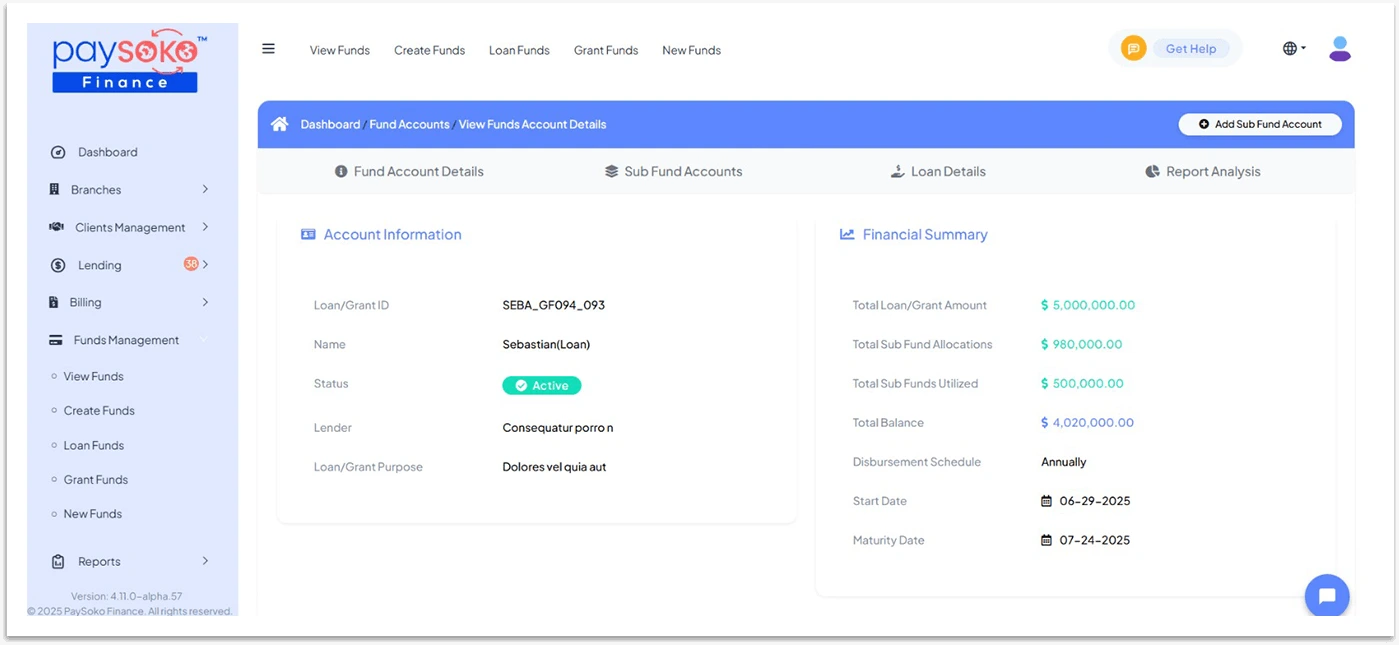

Automated loan servicing with embedded finance simplifies lending from start to finish — streamline approvals, track repayments, and manage loans effortlessly, all while reducing risk and operational workload.

AI-powered financial analysis reads and interprets documents instantly, generating accurate spreads and insights to assess business health, risk, and performance — faster and smarter than ever.

Streamline origination and underwriting with intelligent automation — assess applications, analyze risk, and approve loans faster, with greater accuracy and confidence.

PaySoko’s ERP unifies operations and capital management with real-time transparency and control. From Financial Institutions and Construction to SMBs, Retail, Hospitality, NGOs, Manufacturing, and Infrastructure, organizations gain streamlined operations, accountable fund flows, and data-driven decisions—all in one lightweight, scalable system.

Benefits

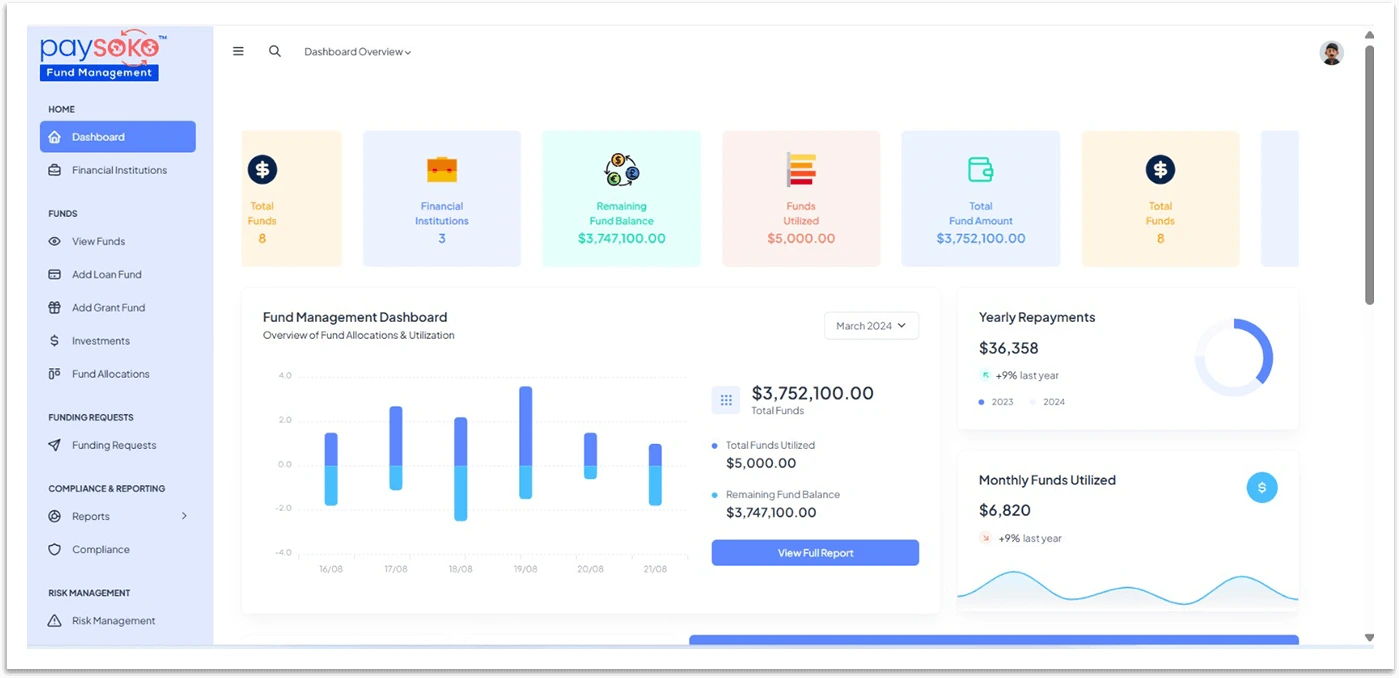

PaySoko Capital Ecosystem Platform Highlights

Automated Loan Management

Reduces operational costs, minimizes human error, and scales loan operations efficiently by automating workflows.

AI-Driven Underwriting

Improves risk assessment accuracy, enabling lending to a wider customer base while controlling defaults.

Fund Management

Ensures optimal allocation of investor and liquidity pool funds with real-time visibility and compliance.

Easy Onboarding & Origination

Increases conversion rates and reduces drop-offs by simplifying the KYC and application processes.

Last Mile Technology for Embedded Financing

Provides our Business Suite of verticalized AI powered operational solutions, seamlessly integrating capital access and business enablement

AI-Powered Financing

Enables personalized offers, optimizes portfolio performance, and improves customer loyalty through tailored products.

Contact

Contact Us

Address

3960 Howard Hughes Pkwy, Suite 500-555,

Las Vegas, Nevada 89169.

Open Hours

Monday - Friday

9:00AM - 05:00PM ET